GLOBAL • INVESTMENT

Brandon Curriston

MAY 25, 2017

When investors are looking for intelligent ways to invest their money, they essentially all have the same goal: make more money. They are leveraging their assets to a certain degree of risk in an effort to profit. The way investors go about doing this, and the methods behind their actions, vary greatly however.

With this understood, we will focus on two different broad strategies: long term vs short term investments. These two ideologies are really a change in mindset more than anything else. While some of the practical implementation may differ as a result of this, the primary shift is binary and must happen mentally first.

In order to understand these two ideologies, we must first define them. By defining them and beginning to understand how they can be used as financial tools in your arsenal, you can become a lot more effective in reaching your goals along with alleviating some frustrations that would otherwise inevitably arise. It is a widely accepted definition that, “short term investments are anything under one year in length. Long term investments would be considered anything over one year in length, and in fact are usually intended to be held for substantially longer.” You can read more on this idea by clicking here.

First, let’s talk short term investments. Within this strategy investors are trying to capitalize on predications or estimated trends in under one year. Investors are studying the market trends and attempting to buy stocks low and sell them high over a short period of time in order to profit (you could classify day trading under this short term strategy as well, although many would argue this is a different topic altogether). Problems arise, however, when uninformed investors approach a short term investment with a long term investment mindset. Investing for the average person, in particular, short term investing is not a get-rich-quick scheme. It is not a repeatable formula that can be taught to turn $10k into $100k in under a year. Of course you may hear sensationalized stories, you may hear buy low and sell high, and it all sounds so easy. But, this approach is in fact extremely difficult. Even knowledgable seasoned veterans have horror stories. If you want to get into short term investing it would be highly advisable to do your own research and start small. There is a high degree of risk involved, and while you can become successful at it, it is far from a sure thing.

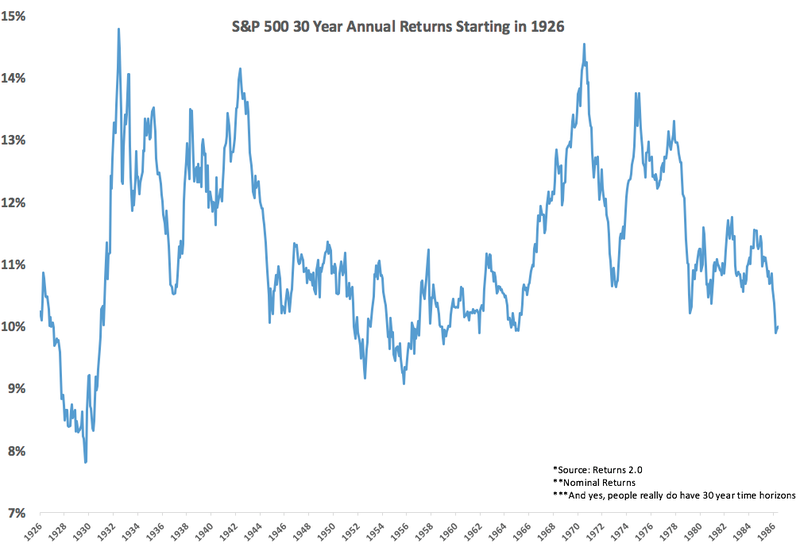

Long term investing has the historical and empirical data to back up the claim it is a valuable growth strategy. Investing for the long term allows for your money to compound and grow substantially over time. It still has its risks, but the data shows it is largely effective. American investor Warren Buffett has said that his preferred time to hold a stock is, “forever.” Prior to the year 2000, the stock market had not had a negative 10 year period since the 1930’s. Since 1950, there has never been a negative 20 year period. Day to day, the stock market is pretty much 50/50. It rises about 53% of the time and falls 47%. However, as you look over longer periods, the picture changes drastically. Given any 12-month period, the market rises 73% of the time. When you judge by 10-year periods, it rises 93% of the time. Those statistics, if using past performance as your barometer, are extremely encouraging when looking towards long term investments.

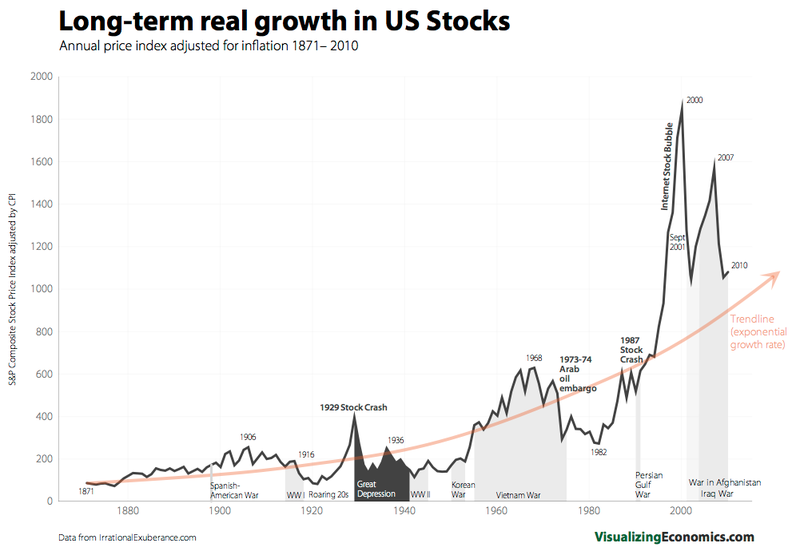

The charts below each highlight different aspects of long term investment, but all of them are pointing to the same conclusions. Long term investment has resulted in returns for investors with alarming regularity. Problems arise for a variety of reasons, and you can read more on that here. But, by being educated, actively engaged, and having a patient long term mindset you will avoid many of the pitfalls that hurt investors.

Source: http://awealthofcommonsense.com/2016/05/deconstructing-30-year-stock-market-returns/

Dow Jones — 100 Year Historical Chart

Source: http://ritholtz.com/2011/01/long-term-stock-market-growth-1871-2010/

Essentially, by investing for the long term you are siding with history and leveraging time as your asset to correct any negative dips in the market. Over time “good” companies and “good” stocks have corrected themselves with investors reaping the benefits. It is important to note that this is not guaranteed to continue. Past performance does not assure future performance. However, if you have made the decision to invest, you could reasonably side with what has traditionally worked and has a proven track record. Additionally, it is important to note, not every stock should be held on to forever just for the sake of claiming it is a long term investment and will correct itself eventually. On the contrary, major changes within the individual company, major market shifts, or a variety of other reasons could be signs to sell investments that initially you had planned to hold for the long term.

When looking at investments a little deeper and especially long term, one area to highlight is emerging markets. Somewhat intuitively, and expanding upon the above philosophy, emerging markets have larger room to grow and thus higher potential ROI. If you give them time to mature (long term strategy) they can reach maturity, or at least be close to their overall cap. Take a simple example: company A is a tech company in a developed market, and company B is a tech company in an emerging market. Company A is valued at $10 per share. Company B is valued at $1 per share. If both have the same potential market cap say $15 per share, then the potential return on your investment for company B is $14 per share in comparison to company A’s return of $5 per share. This rudimentary example is used to highlight the point that the potential for growth is larger in emerging markets. While there are many factors to take into consideration, if you are leveraging time and utilizing a long term investment strategy, emerging markets represent a huge opportunity and a viable area to look at when examining your options. They also could be an excellent way to further diversify your existing portfolio and help additionally mitigate risk. (5 reasons why it is a good time to invest in emerging markets)

Source: http://www.valuewalk.com/2015/12/emerging-markets-2016-outlook/

Emerging markets present significant untapped potential in regards to resources and demographics, as shown in the graphic above. These markets account for nearly three-fourths of the world’s land mass and four-fifths of the world’s population. Additionally, as these countries continue to grow and develop we could expect the gap in GDP and capitalization to close. Those are extremely significant numbers not to be taken lightly when looking at long term investment, potential opportunity, and economic growth.

One specific example of a company with experience and know how in this field is ACE & Company. Specifically, they have capitalized on “direct investments for for private investors.” With 5 offices globally, over 10 years of experience, and over $75M in profit they have a proven track record. Companies such as ACE allow investors to dive into emerging markets with out taking up significant amounts of their own valuable time or experience painful and often costly learning curves. Additionally, they can rest easy knowing there are qualified experts working to help capitalize in an area that is often over looked by other investors.

Investors can look to utilize a variety of strategies to reach their own individual goals. With maximizing profits and minimizing risks as a general guideline, a common investor could make certain generalizations and assumptions. Long term investments have a proven track record and leverage time as their asset to help mitigate risk providing investors with what they ultimately want: more money. Additionally, combining this long term strategy with the huge opportunity that is emerging markets, you have even greater opportunity for growth and return on your investment. Taking advantage of investment firms such as ACE & Company will allow you to do so with minimal effort on your end and further mitigate risk.

You can follow Brandon on Twitter @BCurriston or his personal blog on Medium.

Disclaimer: Seedstars encourages freedom of speech and the expression of diverse views. The views of columnists published on Seedstars are therefore their own and do not necessarily represent the views of Seedstars.