GLOBAL • TECHNOLOGY

Seedstars Global

AUGUST 29, 2023

One year since the launch of Seedstars International Ventures II (our global pre-seed and seed stage fund) and with an average of 2 new investments per month, a growing LP base, a maturing tech stack, multiple follow-on rounds and exits, it was an eventful 12 months. In this article I’ll take you behind the scenes of VC fund life and share some of the key learnings we’ve picked up along the way.

The lifecycle of a VC boils down to five steps, 1) Fundraising, 2) Sourcing+Screening, 3) Investing, 4) Value Creation and 5) Exiting. Let’s dive into each of these steps…

1) Fundraising:

This section is dedicated to all the other emerging VC managers out there living the highs and the lows of fundraising. We were simultaneously extremely lucky and unlucky with our timing (missed the launch news last year? It’s here). On the one hand, first closing in June 2022 was a stroke of luck as we are now deploying into a buyers market with depressed valuations and potentially one of the top performing vintages. On the other hand, the fundraising environment has been horrendous as tech valuations tanked and interest rates keep rising. Prequin reported that just 196 first-time private capital funds have been raised globally so far this year versus 700 in the whole of 2022 and 977 in 2021. Ultimately I think that fundraising as an emerging manager is always going to be one of the hardest things to accomplish and requires immense tenacity and a great support network (team, advisors, family etc) no matter what the markets are doing.

Almost true to Pareto, 70% of our capital came from 20% of our investor base who are classified as institutional investors. We had a clear strategy to focus on large tickets and avoid the long tail. That meant saying no to many smaller tickets which is something to reevaluate for future funds but the legal, administrative and time related issues to handle smaller tickets was just not feasible for us.

42% of capital was from entities we already had a relationship with (partners, investors, mentors etc). The degrees of familiarity varied but this data point confirms what I’d heard before: your network will give you a big boost but not get you all the way to the finish line. As such, to get us to fund closing we had to develop new relationships with 58% of the LPs. 60% of these new relationships were generated thanks to warm introductions. Enough said. You know what to do!

Fundraising tips that you won’t find online:

Sidenote! Fundraising morphs into investor relations and we’ve also had to learn and improve on this by asking for feedback. This feedback loop has enabled us to improve our investor satisfaction score from 4.6 to 4.9 out of 5 over the last year. Our current investor relations formula includes:

i) Real time access to pipeline and portfolio data via our proprietary LP Hub.

ii) Quarterly update calls covering market, macro, pipeline, portfolio and a chat with one portfolio company.

iii) In person meetings whenever travel schedules permit it.

2) Sourcing/Screening:

Given the power law dynamic in VC, access to the right deals is critical. As a result our investment team spends 50% of their time (we know this because we track it) on networking, sourcing and screening activities.

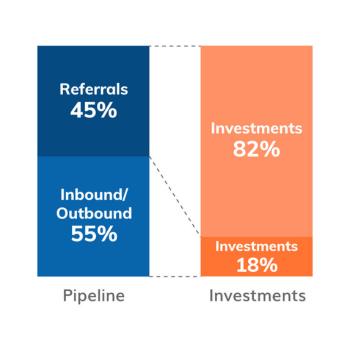

Just under half (45%) of our pipeline comes from referrals (VPs, Founders, VCs, etc) but these referrals make up 82% of the investments we make. Referral networks take time to build and are a two way street. The more you provide, the more you get back. The more value add you give to the portfolio companies, the more likely you are to receive a referral. It’s a reinforcing loop. Note to founders: Warm intros work.

Founders we see are 37 years old on average and have teamed up with 2.26 other co-founders (a good sign based on Super Founders research suggesting that 2 or 3 founders was ideal).

Anecdotally we see downward pressure on valuations with rounds regularly being re-negotiated by VCs (a practice that was unheard of in the prior cycle). However our data regarding the live pre-seed and seed funding rounds being raised doesn’t show any clear trend with the valuations. At pre-seed, post-money valuations have been oscillating between $3.5M - $10.4M on average. At seed stage, post-money valuations have been varying between $6.6M - $11.6M on average.

3) Investing:

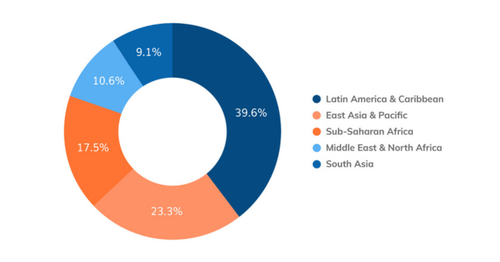

Our investment thesis starts with the underlying view that emerging markets possess the most attractive economic growth opportunities of the coming decades and within that we have defined Future of Finance and Future of Commerce as the two key opportunities with a focus on B2B models.

Within the Emerging Market context, we are primarily focused on the economies expected to be among the top 20 nations by GDP in 2050 according to PWC (India #2, Indonesia #4, Brazil #5, Mexico #7, Nigeria #14, Egypt #15, Pakistan #16, Philippines #19, Vietnam #20). 80% of our investments were made into these markets and the balance into markets including Colombia, Bangladesh, Kenya, Senegal and Thailand.

Since the fund launched last July, we’ve concluded 24 investments, 42% Future of Finance, 58% Future of Commerce.

The financial services industry is one of the largest market opportunities globally with BCG estimating a $12.5 trillion revenue opportunity and FinTechs only controlling 2% of that. Financial wellness is also one of the most important services an individual or business needs to thrive as I discussed in this article. Future of Finance investments examples include Aviva (Mexico), providing a phygital lending solution for tier 3/4 cities with just a video call and Finfra (Indonesia), an embedded finance player.

Within our Future of Commerce vertical, we invest in software and technology that enables the buying and selling of goods and services with a special focus on marketplaces. Be it in the FMCG, automotive, agricultural or legal sector, technology can bring better price transparency, service levels and efficiency. Future of Commerce examples include Jumba (Kenya), a B2B marketplace for the construction industry and Suplyd (Egypt), a B2B marketplace for restaurants.

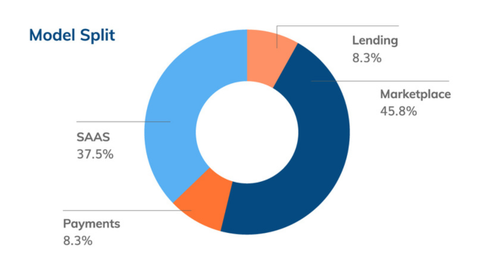

The portfolio companies are most commonly operating as marketplaces (46%) or SAAS (38%) with the balance running Lending or Payments business models. Generally speaking we are rather sceptical of pure SAAS plays with only a monthly subscription as it generally leads to an unattractive revenue opportunity. As such, the majority of our SAAS companies have a revenue strategy that also includes a usage or commission based element.

A few portfolio stats:

One of the best parts of VC is collaborating with other fund teams. Fortunately our style and stage of investing is conducive to collaboration and so we work hard to build and maintain relationships. So far in the last year we have co-invested with 48 funds, and with 7 we’ve done more than one deal together including Canary (Brazil), Carabela (Mexico), Goodwater Capital (US), Hustle Fund (US), Nido Ventures (Mexico), RaliCap (US) and Ventures Platform (Nigeria).

To see all the companies we’ve backed click here.

4) Value Creation:

In Dec 2021 I wrote a piece for TechCrunch titled, ‘Capital is a commodity. Knowing what to do with it is not’. Back then funding levels were at record highs but even in today’s funding winter environment, the title holds true and it’s why we spend a massive amount of resources (especially considering the fund size) on our Value Creation Platform designed to support our portfolio companies.

Our Value Creation Platform is built with this proverb in mind “Give a man a fish, and you feed him for a day. Teach a man to fish, and you feed him for a lifetime.” Concretely this means we focus on transferring skills and processes that can be used long term (potentially indefinitely). In a perfect world, all teams would have access to all the resources necessary to grow quickly and sustainably. In reality, 70% of ventures fail within 2-5 years after a seed round, often, due to ineffective growth strategy and teams that lack the skills, tools, and resources to execute. Consequently we provide teams with the essential building blocks to take the company from product market fit to success at scale. Our internal team aims to catalyse a network of Growth Partners to maximise the transfer of relevant knowledge versus doing everything ourselves. The combination of our inhouse Value Creation Team and the outside Growth Partners gives the best of both worlds: best-in-class growth-related knowledge and actionable advice followed by implementation.

One major challenge with value creation functions is measuring the impact and outcomes. A satisfaction score only determines the perceived value which is important for references and relationships but is not a measure of the outcome. The actual value and influence on a company’s top/bottom line takes longer to see and is easily influenced by many other factors out of our control. As such, we also ask ourselves if we have enabled companies to reach an ‘inflection point’ within the period of our intervention. In the past year the portfolio companies we supported gave us an overall satisfaction score of 8.7/10 and with 76% of them we successfully triggered a growth inflection point.

For more information on how we work with Growth Partners to drive value creation take a look at this in depth article here.

5) Exiting:

Obviously we aren’t exiting Fund II investments yet but that is now a focus for Fund I. In the last year, four portfolio companies offered us early liquidity events (although for some we retained shares). The acquisitions included:

Listopro (Mexico), Jun 2022: Acquired by Revelo (news), a Brazilian market leader backed by Social Capital, FJLabs, Valor Capital, Dalus Capital and IFC.

Undisclosed (Latam), Sep 2022: Multinational corporate entity made a strategic acquisition of a FinTech company.

DocDoc (Colombia), Dec 2022: Acquired by Cardo health (news), a Swedish healthtech investment holding.

MyRobin (Indonesia), Jan 2023: Acquired by Betterplace (news) an Indian market leader backed by Macquarie Capital, Jungle Ventures, Unitus, BII, Capria and 3one4 Capital.

The clear trend among these 4 acquisitions is one of consolidation with regional soon/unicorns snapping up a market leader in a new geography. The challenges of cross border growth and localisation should ensure many more liquidity events are generated this way and continue to provide exits for the funds. Beyond trade sales, secondary market transactions have so far been the other exit route we’ve leveraged and we expect these two routes to generate the vast majority of the liquidity.

6) Behind the scenes:

Bonus section! While the main functions of a VC are indeed the five steps above (Fundraising, Sourcing+Screening, Investing, Value Creation and Exiting) there are a few underlying elements that enable everything to run smoothly and we should definitely talk about two of them: Tech and Team.

Tech:

Our tech story is not just one that just spans the last year but rather the past decade with all the learnings contributing to the current setup. Our current strategy is to do everything 1) inhouse and 2) low code.

Why inhouse? Our experience was that no tool did everything we wanted or had the customisation required (eg, one tool for CRM, another for portfolio administration another for KPI tracking, another for analytics). As such the prior platform ended up with many disparate tools linked with a few interconnectors running in spreadsheets. There was so much room for error and the complexity made it hard to train people or make any progress.

Why low code? Low code tools have been around years and we tried in the past but they were either too limited or too complex. The emergence of Softr.io and others in this category enabled us to build complete applications quickly with almost no limits.

Over the last 18 months we’ve built out a series of applications using a combination of Softr (front end), Airtable (database) and Google Looker Studio (analytics). The modulus includes our internal CRM/pipeline/portfolio management tool (called Andromeda), an LP Hub and a Founders Hub (with Mentor and Investor Hubs coming soon). For now the tech stack ensures consistency and gives us insights into things like deal velocity, valuation trends or performance attribution. The next step is to bring more value to the investment team at the sourcing/screening stage by plugging into OpenAI.

Team:

Saving the most important aspect to the end, the team is what makes everything above tick. None of this would be possible without the support of the Seedstars Group and more specifically, the Seedstars International Ventures team. A massive thank you to everyone for your limitless support, enthusiasm and ideas. One year down, many more to go!

From left to right: Jon Attwell, Samantha Batista, Twwo Jaruthassanakul, Mal Filipowska, Charlie Graham-Brown, Nataly Yousef, Konstantin Hapkemeyer.