AFRICA • INVESTMENT

Seedstars Global

MAY 9, 2022

Seedstars has been dedicated to developing startup ecosystems across emerging markets since 2013 through activities like pitch competitions, programs and investments. After almost 10 years of operations, Seedstars is considered the largest entrepreneurship community across emerging and frontier markets.

Seedstars International Ventures (SIV) is a seed fund and the first ever VC focused exclusively on emerging and frontier markets. It is built on top of the Seedstars Community and leverages it for deal flow and network access. To date, SIV has made 80+ investments across 32 countries in Africa, MENA, Latam, CEE and Asia.

Funding in Africa is faster than the global average

With the youngest population in the world and high rates of entrepreneurship, the African ecosystem is booming. Reports state a 44% year-on-year growth in funding for tech startups, which is six times faster than the global average.

Today, most VC funding goes to the Big Four: Nigeria, Egypt, Kenya and South Africa, who have attracted 83% of all the funding in the region and signed 78% of all $1m+ deals in Africa since 2019. Companies from other countries are raising funds as well, but most of it is driven by a few large deals. As of April 2022, startups in Africa have raised $2.25 billion in the first four months of the year, which is 2.5x times the amount that had been raised by the same time in 2021.

Promising teams and scalable solutions

Over the past years, SIV invested predominantly in companies aligned with global mega trends that materialized across various emerging and frontier markets. Examples for this are alternative lending, B2B marketplaces, logistics solutions, and remittance services.

While SIV is industry agnostic, we’re most excited about solutions to fundamental challenges present across more than one market. The team is the most important to us, which is why we are looking to partner with the most promising founders who are building scalable solutions to real problems.

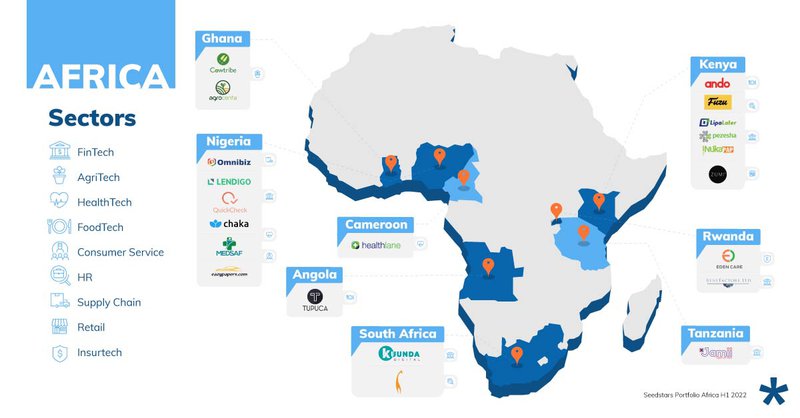

Some of our notable investments across the continent include Omnibiz, Chaka, LipaLater, Pezesha, QuickCheck, Fuzu, Zumi, Medsaf, Ando Foods, Kuunda and Eden Care.

Over the past months we closed two exciting deals in Senegal and Kenya which will be announced soon.

How do we support ventures on their road to success?

As companies need more than just capital to succeed, we transfer knowledge, tools and processes to our portfolio companies so they can take their venture to the next level. Read more here about our value creation platform.

Our biggest focus lies on growth. Every company we invest in embarks on a three-month long Growth Track, where we pair them up with an experienced growth executive to implement a best in class growth process into the company . On top of this, startups get access to our global network of VCs, entrepreneurs and corporates.

Do you think your company is a perfect fit to become a part of our portfolio, but you have some questions? Join us in a live Meet & Greet session with our Investment Manager for Africa Konstantin Hapkemeyer on June 28th at 4pm CAT/CEST. Register here.

To get a head start you can also submit your pitch to Seedstars International Ventures.