MENA • FINANCIAL SERVICES

Ricardo Silva

SEPTEMBER 27, 2017

Egypt’s an interesting country – for business and otherwise. Still unsure of its footing after a wave of revolution(s), it looks to its economy to sustain some form of stability. There’s high potential, given a population over 90 million and uniquely positioned between the Middle East and North Africa – helped by a blossoming startup ecosystem with coworking places popping up all over – but still a long way to go.

The Fintech sector/vertical is typically the first step for an economy looking to ride the digital wave: payment, lending and capital raising solutions/startups enable other more complex digital businesses to grow. (Check Wamda/Payfort’s Fintech report in MENA)

From the macroeconomic point of view, the government is seemingly helpful but strapped for cash. To obtain a much-needed loan by the IMF, Egypt has gone through a harsh currency devaluation, subsidy cuts on fuel, utilities and other essential goods (which lead to inflation over 30%).

The government HAS been trying to enable the private sector, doing policy work on SME lending, microfinance, and others – to avoid lending being dominated by treasury bills – and facilitating “innovation” in financing public works, e.g.: Suez Canal expansion.

In a country where only around 14% of the population has a bank account, all of this can be prime territory for startups and different solutions.

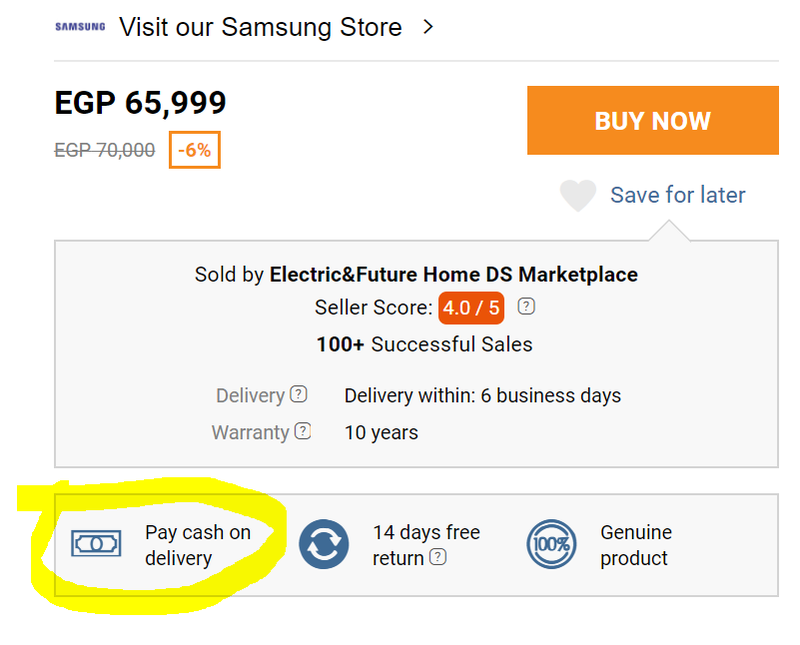

Very much a cash economy, borrowing is seen as demeaning– even for businesses – financial literacy is low – and it reaches an extent that fascinates me: being able to order a fridge or mobile phone online.. and pay cash on delivery?

Definitely appreciate it, as my non-Egyptian cards never seem to work.

Truly interesting is also the aversion to the concept of interest (“riba” more specifically) – while a noble intention to be a safeguard from the abuses of capitalism, there is a reason why interest exists and even the Central Bank of Egypt lists its rates. Will startups change this? Should they? Or should they stick to “service fees”?

Regulations pretty much mandate that fintech startups partner with banks in order to be able to operate – and banking licenses are hard to come by.

This can turn into a chicken and egg situation, as to prove that a formal partnership is a good idea, you first have to provide a proof of concept of your business idea, which requires actually operating, which requires a formal partnership…

“[Regulations] are not evil, but banking information and access are sort of a taboo here and it is quite hard to explain that fintech is truly the solution for financial inclusion, financial illiteracy, and informal banking.” – Wamda

Indeed, some entrepreneurs report that entities such as the Central Bank of Egypt can be “extraordinarily friendly and open about new technology if you just manage to find the right person to talk to”.

To help leapfrog the issue, local fintech accelerators such as American University of Cairo’s Venture Labs (with CIB) or 1864 accelerator (Flat6Labs + Barclays) partner up with specific banks in order to facilitate the proper introductions.

Many promising fintech startups are popping up and being smart about their context, beyond the typical digital wallets by telecoms. One I enjoyed meeting personally was MoneyFellows, bringing “gameya”, the tradition of money circles – completely foreign to me – into the digital world.

Fawry is another great example, equipping a network of thousands of small retailers with simple POS terminals – literally the small shops found on every corner – enabling anyone to pay for services such as utilities, insurance, education, travel tickets without using a card… Reminds me of the “multibanco”/ATM network in Portugal, an old but extremely practical system which still beats buying train tickets from the actual website – but Fawry’s network is human powered instead of bank supported.

But there’s a lot of market gaps to fill – which means opportunity.

Seedstars is setting up in Egypt – leveraging its global network and portfolio companies that can be replicated – to build ventures that address these needs. Doing this by testing ideas, validating the ones that work and actually turning them into companies by putting a team and investment together. This is exciting as it means leveraging local talent and working with the local community to build global success stories that start here.

So looking forward to the next few months.