GLOBAL • INVESTMENT

Alisee De Tonnac

JUNE 5, 2017

An ‘emerging market’ is any country that has many characteristics of a developed market, but does not yet meet the standards to be considered ‘developed’ by the Market Classification Framework. Emerging markets are centres of innovation. Nigeria, Colombia, and Indonesia are no longer symbols of corruption, drug wars, or overpopulation, but actual incubators of talented entrepreneurs.

By 2034, 95% of the world’s population will be in emerging markets and in just three years from now, in 2020, 80% of all smartphones will be located in emerging markets. Moreover, 89.8% of the world population under 30 years of age live in these regions, which represents a huge pool of untapped talent. It was only last year when the Chinese economist, Zhu Min, and Deputy Managing Director of the IMF, claimed, “People will remember 2015 as the year emerging markets took half of the global GDP.”

Source Market Realist, “E-Commerce in Emerging Markets: The Biggest Growth Opportunity”

Compared to North America and Europe, emerging markets find themselves with themselves with much lower GDP per capita and arguably inferior life satisfaction. However, that’s an opportunity to change the status quo in these regions!

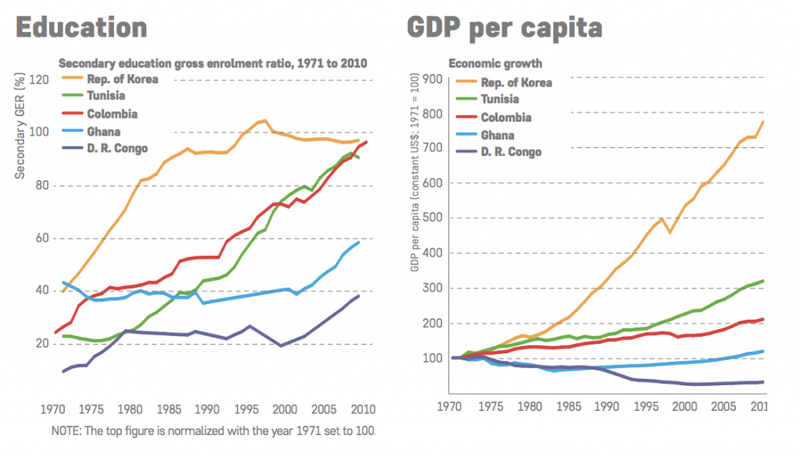

Now, let’s take an even closer look. If you compare South Korea to Nigeria, back in 1965, the difference between the GDP per capita was two-fold. Looking at the situation today, that gap is 22x bigger.

Without going into too much detail on all the reasons as to why this shift happened in South Korea, let’s look at two major forces: that of the public sector and private sector. The government initiated a very clear strategy of specialising the workforce in higher value added services, such as electronics (everybody knows Samsung, right?). Even nowadays, it continues to have a clear strategy to build niche expertise. Second, it deployed a range of mechanisms to develop the necessary skills in advance and invested heavily into education. As we can see from the graphic on the right, education has a direct impact on the GDP per capita.

This investment not only creates jobs, but balances higher value-added jobs with manufacturing and labour intensive jobs. It is important to point out that many times when we discuss the issue of unemployment in emerging markets we tend to focus solely on unemployment, however, there is a huge need to put greater emphasis and attention on the proportion of unstable jobs.

Throughout all stages of development, South Korea attempts to strike a balance between labour intensive, lower skill industries that provide jobs for many, and more knowledge intensive industries that require a higher level of skills.

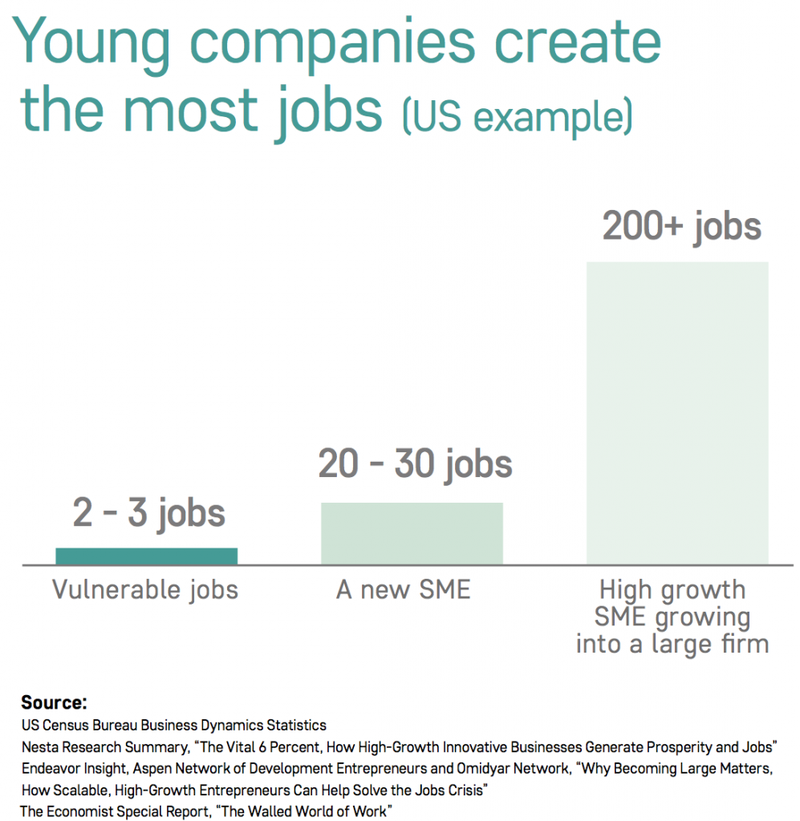

Now, let’s look at the private sector. This is where we can have an impact. Over the next decade, more than 1 billion young people will enter the global labour market and 90% of these jobs will be created by the private sector, fueled by Small and Medium Enterprises (SMEs), including startups.

Looking at an example of the US, companies that are less than 5 years old, startups, and SMEs are the ones that are creating the most jobs. Zooming in even further, when one compares the job creation between microenterprises, SMEs, and high growth markets, the SMEs create the most jobs.

Seedstars is focusing on these companies. According to the innovation foundation Nesta, in the UK, 6% of firms create 50% of new jobs and GDP growth. Indeed, high growth companies = high impact.

And the high impact is nearly always thanks to technology. Technology is changing the world, and we are still at the beginning of seeing its effects, having an unprecedented impact on millions – even billions – of people at a speed never reached before.

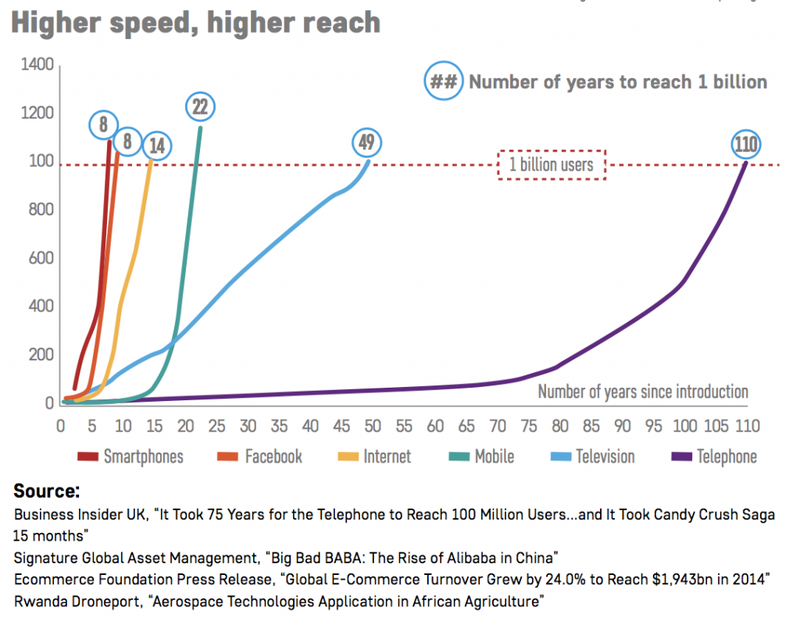

Remember, it took us over 100 years to get to one billion consumers and less than 10 years to reach a billion smartphone users. In developed markets, we tend to say that technology destroys jobs, but what about jobs that don’t even exist yet? The reality is that soon, 60% of today’s population will be working in jobs that don’t exist yet.

Let’s take the example of retail: There are fewer retail outlets in APAC than other regions. Currently, the ratio of consumers to retail outlet in the USA is 1000 to 1 vs. over 90,000 people for every retail outlet in the APAC region. Trends predict that the solution to balancing the need for more retail options will not necessarily be more retail outlets, but more e-commerce. A whole economy of solutions will be built around it. Therefore, technology will not only create new types of jobs at an unprecedented speed; it will also give access to (new) services to millions of people.

When we see that the Rwandese government is right now modifying its aerial regulations to allow cargo drones to fly over the city of Kigali, we wonder if innovation will not be taking place in these markets. A foundation to start from for the next generation of technology.