GLOBAL • INVESTMENT

Ilma Ibrišević

FEBRUARY 24, 2020

The article is based on the training we provide for startups during the Growth Programs .

You had a brilliant idea. You found the sweet spot at the intersection of creating value for customers and profitability. You might even have employees, supporters, and you might be already selling your product/service.

But to really get your startup company off the ground, you need capital. And to attain capital, you need to fundraise. Ah, the dreaded word!

And fundraising isn’t easy. You need to develop a thick skin and handle a lot of no’s. The time will seem to be dragging on and each ‘let’s keep in touch’ will weigh heavy on you. Fundraising can indeed be a lonely, anxiety-ridden, and frustrating process.

But there’s light at the end of the tunnel! In hopes of helping you see it, we share the basics of a fundraising strategy for early-stage startups.

The earliest stage of funding a new startup comes so early in the process that it’s not generally included among rounds of funding at all. Known as "pre-seed" funding, this stage typically refers to the period in which a company's founders are first getting their operations off the ground. The most common "pre-seed" funders are the founders themselves, as well as close friends, supporters, and family.

It's not uncommon for startups to then engage in what is known as "seed" funding or angel investor funding at the outset. Seed funding helps a company to finance its first steps, including things like market research and product development. It's not uncommon for these rounds to produce anywhere from $10,000 up to $2 million for the startup in question. Many startups never proceed to Series A, B, and C funding rounds.

Next, these funding rounds can be followed by Series A, B, and C funding rounds, as well as additional efforts to earn capital as well, if appropriate. Series A, B, and C are necessary ingredients for a business that decides “bootstrapping,” or merely surviving off of the generosity of friends, family, and the depth of their own pockets, cannot or will not suffice.

The rounds of funding work in essentially the same basic manner; investors offer cash in return for an equity stake in the business. Between the rounds, investors make slightly different demands on the startup.

Here’s what you need to know to kick-off the process of fundraising for your startup company.

Note: This is not intended to be a complete guide to fundraising. It includes only the basic knowledge most founders will need.

Whatever the stage of your startup, whatever your goals, whatever your valuation, one thing remains the same. You need to create a fundraising strategy.

A fundraising strategy outlines, simply put, how you plan on going about raising funds. A fundraising strategy is ideally a written document (although it doesn’t have to necessarily be too long or elaborate). The very process of writing this document will invite valuable conversations and encourage important thinking processes.

Your fundraising strategic plan needs reliable groundwork in order to properly position you in front of the right people.

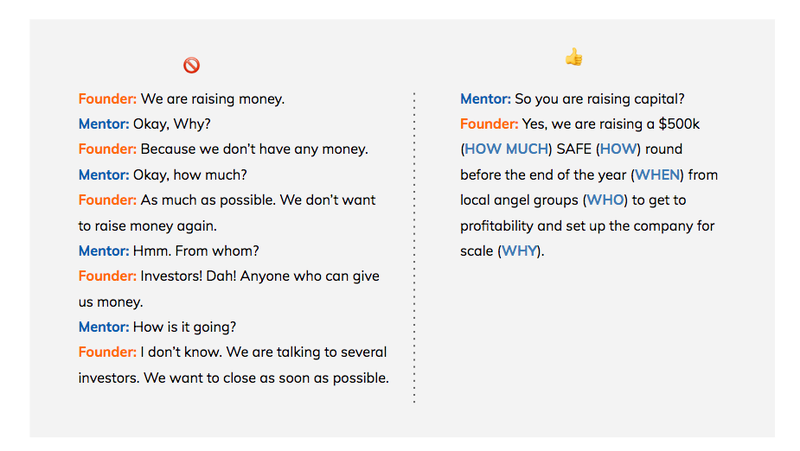

A good fundraising strategy, at the very least, clearly responds to these five questions:

Why - Why are you raising capital?

Who - Who are you raising the capital from?

How much - How much capital will you raise? (Now and in the future)

When - When are you raising capital? (Now and in the future)

How - How will you go about raising the funds? (Process)

📍Do you have your fundraising strategy in place? Apply for funding here.❗

Here’s how you can go about answering these five questions.

Before creating a fundraising strategy and before any round of funding begins, it’s necessary to undertake a valuation of your startup.

Valuations are derived from many different factors, including management, proven track record, market size, and risk.

In turn, these factors impact the types of investors likely to get involved and the reasons why your company may be seeking new capital. Essentially, the valuation will help you start answering the five key questions listed above.

An all too common mistake that many early-stage startup companies make is going into fundraising blindly.

Knowing why you’re raising funds is quintessential to raising funds. And ‘Because isn’t that what startups do?’ isn’t a good enough answer.

Take time to understand what you need the money for? What are you going to accomplish with the money that you raise? What are the milestones it will help you hit (e.g. speed to market, grab market share, exploit a market opportunity)? And don’t forget that investors don’t fund capital shortages, they fund opportunities.

Setting clear, specific, achievable, measurable and time-bound goals is invaluable to creating an effective fundraising strategy.

It’s also important to be strategic about when you raise funds. Timing matters!

You want to raise from a position of strength. As a rough guide, raise money when you have figured out what the market opportunity is and who the customer is, and when you have delivered a product that matches the needs of customers and is being adopted at an interestingly rapid rate.

Finally, don't let your fundraising drag on for months on end. VCs need to be incentivized to make a decision, otherwise, their deliberation might go on forever, as they pay attention to other more time-sensitive deals and continue collecting more information about your company.

Investors often do their due diligence on you. And you should be doing the same. You’re choosing investors as much as they’re choosing you.

Investor research should be considered a must-do prior to fundraising. It should be based on two principles: targeting the right investors and doing unbiased research.

A small, early-stage startup that aims to grow slowly will want to target a very different set of investors compared to a tech firm that wants to scale up fast in hopes of being acquired by a giant, for example.

Reach out to anyone in your network — entrepreneurs or not — who knows the investor you’re targeting and ask them for their candid thoughts.

Choose investors that will not only provide the capital but will also truly believe in you and stick with you through thick and thin.

Find out more about who your investors are, their strengths and weaknesses, and ways they can add value to your company in addition to their investment.

Make sure your investors are the right fit in terms of your stage sector, geography, and ticket size.

Note: There are multiple funding sources out there in addition to VC funding. Your fundraising strategy should clearly outline all the current/planned funding sources (investors, incubators/accelerators, customers, bank loans, personal savings, bootstrapping, and more). These often come in a progression in an early-stage startup’s life (all the way from bootstrapping to venture capital).

In addition to knowing who you’re raising capital from, it’s crucial to know which amounts you’re hoping to raise from them.

Don’t just pick arbitrary figures. Base your decision on facts and realistic assumptions. Define clear milestones. Forecast your funding needs throughout the entire lifetime of your business. Be optimistic about what your company can achieve, but not preposterous.

It is typically recommended to raise as much money as needed to get to your next “fundable” milestone, which will usually be 12 to 18 months later. In any event, the amount you’re asking for must be tied to a believable plan.

One way to look at the optimal amount to raise in your first round is to decide how many months of operation you want to fund (here we are concerned with early raises, which usually range from a few hundreds of thousands of dollars up to two million dollars).

Fundraising should be approached and managed as a process. Once you have your fundraising strategy, it’s important to use it as a guideline for your fundraising activities (and adjust it as you receive new information).

Your fundraising strategy should clearly outline how you’re planning to reach out to every investor – through which channel, when, and how.

You will make your life easier if you automate some of the processes and prepare as much as possible. Have a sturdy CRM containing all your potential investors and the information about them. Create a system which will contain all the information you need on each investor and where you’re at with them in the process (emails, meeting notes, reminders, etc.)

Have all the necessary documentation that investors are looking for ready at all times (KPIs, cap table, term sheets, financial model, contracts). Not only does it make it easier for you, but the investors too.

Every investor is different. Some investors are hyper-focused on product or service specifics, some aren’t. Some want to hear more about your personal story and why it matters to you to create this particular business, some don’t.

Tailoring your pitch to your investors couldn’t be more paramount, especially when it comes to creating a fundraising strategy that works. Cookie-cutter pitches just won’t cut it.

Before a meeting with an investor, learn as much as possible about them and prepare 3-5 key points to convey in that meeting. Some key points will, naturally, be the same for each investor, but the rest should be more customized.

On that note, make sure your investor pitch is polished. Start with meeting angel investors and VCs you’re less in love with first, and then iterate and iron out kinks in your pitch and deck after every meeting. Then, go for your best VC meeting.

When you feel like you’ve heard basically every question/concern/objection and have rock-solid answers for addressing each one of them, go for it with your most wanted investor(s).

The ecosystem for early startup financing is far more complex now than it was only a few years ago.

There are many new VC firms, sometimes called “super-angels,” or “micro VCs”, which explicitly target brand new, very early-stage companies. New fundraising options have also arisen (for example angels pooling their resources and following a single lead angel or massive crowdfunding campaigns).

Fundraising is a painful, but necessary task most startups have to periodically endure. But with enough persistence, dedication, and grit – the hill can be climbed, and the view will be spectacular!

Apply for funding here.

Download our Investment Readiness Checklist.