GLOBAL • FINTECH

Mark Linsdell

JULY 12, 2019

Trust towards businesses is a scarce commodity in 2019. This is especially true for banks who are among the most distrusted businesses. Public sentiment towards traditional financial institutions was neatly summarised by a partner at New Enterprise Associates, Rick Yung:

"There's a massive shift in consumer behavior and consumer trust"

“I think coming out of [the financial crisis], millennials have a massive distrust of existing financial services. They tend to trust technology more than the recognized stalwart brands, like a JPMorgan Chase or a Wells Fargo."

Newer generations are moving away from previous financial mainstays and putting their trust in tech. As a result, fintech is a booming industry. Last year alone, there was a whopping $40 billion invested in the industry.

However, as fintech becomes mainstream, your startup should be wary of avoiding the distrust that can attach itself to financial services providers.

But, how can you build trust with consumers? Well, one way is through your owned media content. Millennials prefer to learn about companies through content rather than traditional advertising. Therefore, content marketing should be a focus of fintech.

That’s why we’re delving into 3 fintech marketing trends you can apply to your content marketing efforts, to help you build and maintain trust with your target audience.

Your business might consider developing personalized content that educates users on how your product can solve existing problems or help them get set up with financial products.

A great example is cloud accountancy company, Freshbooks. It provides this type of content marketing on its website, categorised into sections including ‘Invoicing & Expenses’, ‘Time Tracking & Projects’ and ‘Accounting & Taxes’. These unpack common problems experienced by its target market, which its products provide a solution to.

With this in mind, you’ll want to identify the problems that your target audience is facing when it comes to financial technology. You probably already have a broad knowledge of the issues facing consumers within the industry. However, it’s still worth crossing the I’s and dotting the T’s and making sure you’re answering the right questions.

Here are a few ways to uncover the pain points of your customers: :

This type of content is highly valuable to readers. It helps them solve and navigate common problems which in turn helps to build and foster trust in your brand.

You shouldn’t focus all your owned media efforts on content that’s specific to your product. In order to build trust with your audience, you should also produce content that addresses other wants and needs of your target market, which may be unrelated to your product.

Why would you do this?

Well, because this type of content demonstrates how well you know your customers.

A great example of this kind of content is the online lending company, SoFi. Its main services are Student Loan Refinancing and Private Student Loans. Therefore, its target audience are American college students and recent graduates.

As a result, it’s created content for that specific demographic. For example, some of the blogs on its site include ‘finding the perfect college part-time job for your major’ and ‘budget-friendly Fourth of July party ideas’.

This content is not related to student loans. However, it’s still content that the target audience will find useful and interesting.

So how can you identify the wants and needs of your customers?

This is where buyer personas become vital. You no doubt already know who your target customer is, but by creating buyer personas you can really start to understand what makes them tick. This enables you to identify their wants and needs outside of your product and start creating content that addresses these.

Since forever, traditional financial firms have buried their terms and conditions in the small print. You can gain a huge advantage by making them as transparent as possible throughout your customer journey.

Why do this? Well, it shows you have ‘nothing to hide’.

As well as being transparent, your messaging should aim to be as simple as possible. Traditional financial products can seem boring to younger consumers. Therefore, simplicity and transparency are possibly the two most important characteristics of your communications.

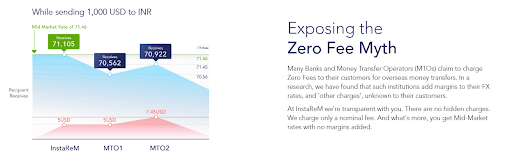

A good example of a fintech company hitting both of these points in its messaging is international money transfer company InstaREM.

In this example, the company is calling out the fact competitors often advertise zero fees but then hide these within their margins. Whereas InstaREM is transparent with the fees it charges customers.

Transparency and simplicity should form the cornerstone of your messaging. It makes your product less daunting and easier to understand. And just as importantly, by being transparent you can also build trust among your target audience.

The banking and finance landscape is fundamentally changing. A new generation of consumers are favoring tech over tradition and fintechs are well poised to take advantage of this.

However, for your business to succeed in this ever-expanding industry, you cannot rely simply on a superior product or user experience. You have to be trustworthy.

Problem-solving content, content relevant to your target audience, as well as brand simplicity and transparency are three ways you can begin to build and maintain consumer trust.

Written by Mark Linsdell, Marketing Associate at Publicize, who specializes in PR for fintech companies and other tech verticals.